Foreword

This is a quick note, which tends to be just off the cuff thoughts/ideas that look at current market situations, and to try to encourage some discussions.

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Tethered

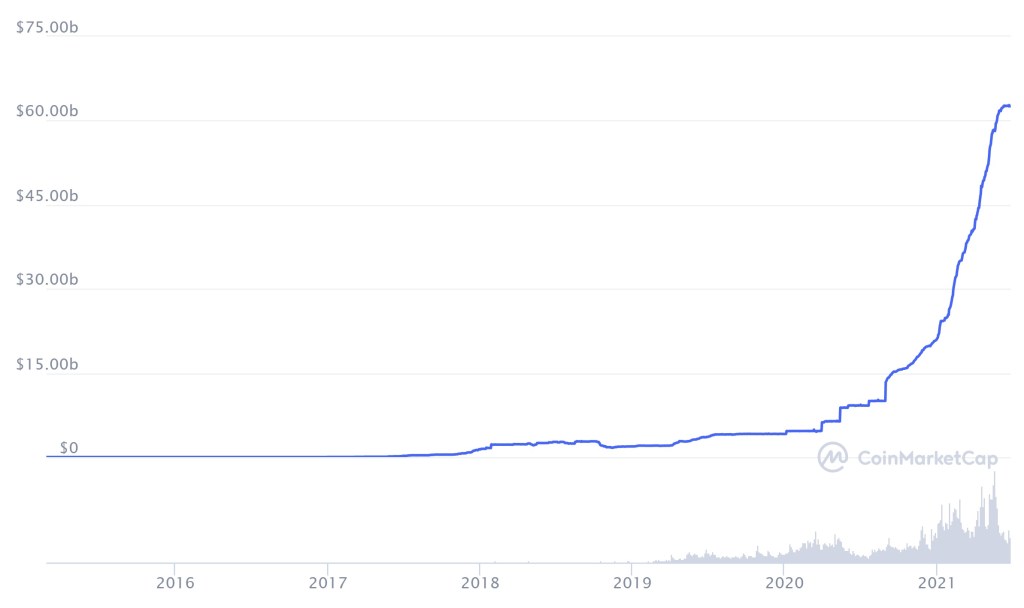

Around the start of 2021, the “market cap” (1) of Tether (2) started increasing at a phenomenal rate. In the first month of 2021, it grew by about 25%, then 35% in February, but “only” 14% in March. April saw another 25% spurt of growth, but May and June, together, saw “only” a 22% growth, with most of the growth in May and June mostly flat, with even a slight dip in late June.

Prior to around late 2020, the crypto space was mostly the playground of more libertarian minded folks, and for the most part, ignored by most large institutional entities.

However, around late 2020, and especially in early 2021, a few large institutional players started taking note of crypto, and initiated positions in the space. The reverse is also true — the provider of Tether claims that the majority of its assets were held in more traditional financial instruments, such as commercial paper (i.e.: short term corporate debt), corporate bonds (i.e.: longer term corporate debt), funds, etc.

So — Tether is “backed” (3) by corporate debt, while some (possibly same, possibly different) corporations have crypto on their balance sheets, and finally, Tether is part of many conversion pathways between many crypto coins and fiat currencies (4).

Leverage

There is anecdotal evidence to suggest that Tether is involved in a bunch of highly leveraged (5) crypto trades, and the increased use of Tether may be a symptom of the increase in leverage in crypto in general. Note that Tether is hardly the only stablecoin — there are a ton of these currently operating, mostly tied to the US dollar, though some are tied to other fiat currencies.

Other than the explosion of stablecoins, there are also anecdotal evidence that some firms are speculating on crypto coins with leverage. For example, MicroStrategy recent issued a bunch of junk bonds in order to buy bitcoin.

Linked

So what we have, is:

- Some firms issuing bonds (i.e.: debt) to buy crypto coins.

- At the same time, some crypto coins (not necessarily the same coins as the ones above) are backed by corporate bonds (again, not necessarily the same as the bonds above).

Even though the coins/bonds in both those statements need not be the same coins/bonds, there will likely be some form of linkage, albeit potentially tenuous. For example, bond funds and algorithmic trading firms (i.e.: quant hedge funds) tend to lump individual corporate bonds into groups, and then trade everything in the same group as basically interchangeable.

Thirty thousand dollars under the C(oin)

Currently, Bitcoin is trading at around 31 thousand dollars, having repeatedly tested the 30-31 thousand range recently, and more broadly (since mid April) grinding downwards. Given that Bitcoin started the year just below 30 thousand dollars, almost everyone who bought bitcoin in 2021 is underwater on their 2021 purchases.

Get to the damn point

All the above is basically just a “quick” introduction to the space, and to make the following points:

- Many institutions initiated crypto positions in 2021.

- Bitcoin, by far the most popular crypto coin (6), is basically flat on the year. (7)

- There is a lot of leverage in crypto.

- There are non-trivial and often non-obvious linkages between cryptos and more traditional financial assets.

Given the above, it seems to me, that if bitcoin were to fall decisively below around the 29 thousand dollars mark (a drop of around 7%), and stay there for more than a few days, there is a decent chance that a few of the institutions may sell (or be forced to sell, due to being overly leveraged), resulting in a cascade of selling between the linked assets, as over levered players are forced to unwind.

Which is the nice way of saying “contagion”.

It probably won’t be terrible. Despite the large numbers involved in crypto, which dwarves the numbers we saw during the Great Financial Crisis of 2008, many players in the crypto space are relatively price insensitive, and many bought in before the 2020/2021 run up in crypto prices, so they may not even be underwater.

So while there may be pain (and very intense pain at that) in the linked assets during the unwinding of leverage, it probably (hopefully!) won’t result in financial armageddon like in 2008, i.e.: the pain will probably (really, really hopefully) be contained to the linked assets.

That said, it’s not clear to me that if (and that’s a very big if) such an unwind were to occur, whether the prices will quickly return to their pre-unwind values, or if they’d languish around or even go down more.

I guess we’ll just have to wait and see.

Footnotes

- More accurately, the spot value of all outstanding Tether coins.

- Tether is a stablecoin, a type of crypto coin whose value is supposed to be tied to fiat currencies like the US dollar.

- More than a few financial analysts have questioned the Tether disclosures, since those numbers would make Tether one of the largest holders of corporate debt instruments. Yet prior to these disclosures, almost no large bank/analyst firm had Tether on their radar, which is rare. It’s possible, but unlikely.

- Many crypto brokerages actually do not trade in fiat — they may not have the proper licenses with the relevant regulators. Instead, they trade only in stablecoins (i.e.: you are buying a stablecoin when you sell another crypto, and selling a stablecoin to buy another crypto). This isn’t always obvious to the end user, because these brokerages sometimes represent the trading as being against fiat currencies. One recent example is El Salvador’s law making bitcoin legal tender — users put in US dollars, which are then immediately converted into Tether, which is then used to buy the bitcoins.

- I guess “highly leveraged” is a matter of perspectives. Traditional stock trading only allows 2x leverage, but crypto trading tends to allow for much more, e.g.: Kraken, Binance, etc.

- Almost all institutions speculating in crypto coins are only in bitcoin, since it has the most liquidity, and is the most recognized.

- In the crypto space, anything less than a 10% move over a few months is basically “flat”.