Foreword

This is a quick note, which tends to be just off the cuff thoughts/ideas that look at current market situations, and to try to encourage some discussions.

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Covid-19 strikes back

Since around early July, stocks have been trading mostly sideways with a slight downward bias in the previous week. Yesterday (7/19), stocks took a ~1.5% dive, while volatility, as measured by the VIX, peaked at over 24 from a sleepy sub-18 print last Friday. This decidedly reddish hue of green caused a bit of a stir, especially since it is hitting in the middle of summer, a period traditionally marked by quiet markets as traders are busy with their vacations.

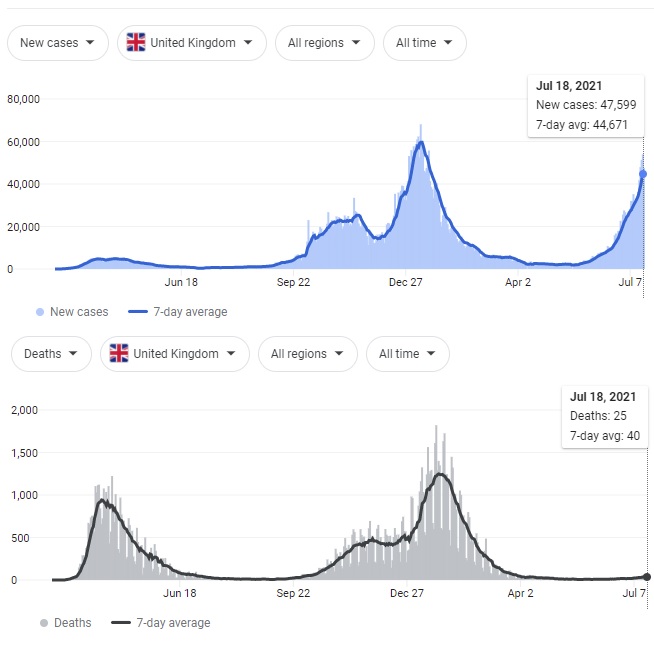

The financial news media is abuzz with suggestions that a rise in Covid-19 cases, this time by the delta variant, is to blame. Multiple countries are seeing an uptick in Covid-19 cases, with the UK especially apparent — cases in the UK are at 70% of all time highs (around 48k cases/day, compared to around 68k/day at the highs), and appears on track to take out the highs in a week or two. UK health officials and media are flirting with the idea of lockdown again, though Boris Johnson did not relent, with Freedom Day finally arriving yesterday.

The rise of the vaccinated

Despite the seemingly grim news, there is a ray of hope. While cases have been rising, death toll from Covid-19 has been surprisingly muted:

Some have speculated that this is due to the high rate of vaccination in the UK (at 70% of the population having at least one dose, it’s one of the highest in the world), while others have suggested that better treatments available, now that doctors and researchers have had more time and experience. Regardless, based only on the UK’s numbers in the past 7 days, the current death rate (1) for Covid-19 is lower than that for the flu (2).

A few random countries I picked show similar trends (cases up but deaths down) or better (cases and deaths both down). None of the 10 or so countries I randomly tried saw increasing death rate (as a ratio of case count).

So, unless that death rate suddenly spikes dramatically (3), it seems like the market may be overreacting slightly, assuming their only concern is the rise of Covid-19.

The cyber menace

If only that was the only thing we need to worry about. Over the weekend, a report came out suggesting that some of the major cyber attacks on US soil (4) in recent memory had links to China. President Biden made it official yesterday in an official White House press release, and the statement was backed by a few American allies.

Perhaps I’m still suffering from PTSD (5) due to the trade war of 2018, but this has undertones of a time when I’d rather not revisit, especially in light of the recent tensions due to big tech regulations, human rights, etc.

Hopefully a peaceful diplomatic solution can be found, but at least in the short term, it’s another thing to think about.

The last meme

Something that I’ve prognosticated on since last July (6), was the return of normalcy. The thesis being that with everyone cooped up at home, there is a natural draw towards more retail trading, but with reopening (7), “other stuff” will naturally take up our time, which should reduce retail trading volumes. And if retail traders were mainly the culprits bidding up markets (specifically meme stocks), then a lack thereof of such may portend dark tidings.

So far, this is sort of happening — meme stocks hit a crescendo in February/March and have been mostly leaking lower ever since.

Finally, with the end of fiscal support, especially the eviction/foreclosure moratorium, around the end of July, the impetus is there for more folks to hunt just a little bit harder for their next job, and recent joblessness numbers are reflecting that.

And well, it’s just harder to day trade meme stock options when you’re working, y’know?

Attack of the karma

Of course, now that I’ve typed this all out (despite the tone and date of the post, I’m actually typing this on the evening of July 19), you can bet that the markets will open (7/20) green and make new all time highs before lunch (8).

Because. Just because.

Footnotes

- This is not a perfect measure — deaths are strictly a “lagging” indicator, while a non-trivial number of people are probably misclassified either way (died from Covid-19 labelled as died from other causes and vice versa). At the same time, there’s probably a good number of people who are infected but are not captured by official statistics for various reasons.

- According to https://www.goodrx.com/blog/flu-vs-coronavirus-mortality-and-death-rates-by-year/, death rate for flu is around 61k/45m = 0.14%. Based on the UK’s last 7 days average numbers, death rate for Covid-19 in the UK, in the past 7 days, is around 40/44671 = 0.1%.

- It might! Again, deaths necessarily lag infections.

- Can you actually say a cyber attack is on “US soil”? Seems kinda weird?

- I happen to be trading FX algorithmically in 2018, and well, you always trade FX with leverage. Huge amounts of leverage. Makes for very unpleasant blood pressure graphs whenever ex-President Trump tweets anything about the trade war.

- If your predictions don’t come true, try, try again. Eventually they will come true. Or everyone will have died of old age and nobody will remember anyway.

- Remember folks predicting that we’d be reopening in July… 2020?

- Absolutely not investment advice. Though if you do bet on it and made money, you’re welcome. 🙂