Foreword

This is a quick note, which tends to be just off the cuff thoughts/ideas that look at current market situations, and to try to encourage some discussions.

It’s early August, just one month away from the seasonally weakest month of the year for stocks, September. Time to make some moves?

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Weakest month

September is, traditionally speaking, the weakest month of the year, followed by August. There have been various theories put forth to explain this seeming affront to the Efficient Market Hypothesis, such as the end of summer where trader starts waking up from their vacation lull, the need to sell off assets to pay for a new school year, the selling of assets for tax lost harvesting, etc.

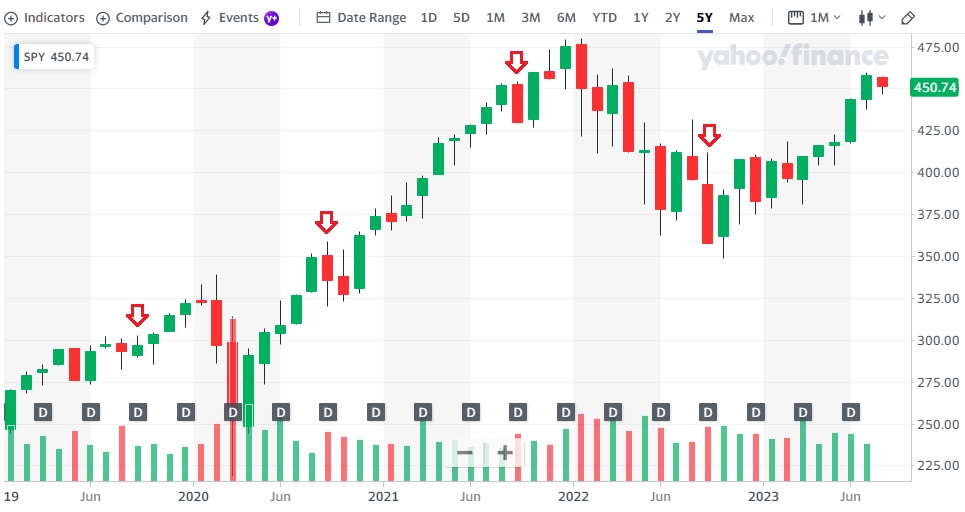

Whatever you may believe, it is undeniable that there is a fairly strong negative August/September effect for stocks:

My portfolio

If you’ve been following me on StockClubs (1), an app that I’ve invested in, you may remember that I flattened my portfolio on September 2021, which worked out well initially with 2022 being a terrible year for stocks in general. However, at the end of 2022, I also initiated a bunch of shorts thinking the weakness will persist, but of course the market gods just laughed in my face and the market ripped higher (2).

As September 2023 rolls around, I’m getting that uneasy feeling again in the pits of my stomach, and if you’re still following me on StockClubs, you’ll note that I bought a put spread, betting that markets will be quite a bit weaker by mid November.

Why, why, tell me why

To be clear, I have a spotty track record at best at timing the markets, and unless you like losing money, it may not be prudent to follow in this fool’s quest. But here are some of the issues weighing on my mind:

Liquidity

In an earlier post, I noted that liquidity is draining from the markets. While I was waffling a bit and undecided on how that’d affect markets, I am beginning to warm to the idea that on the net, this would be market negative, especially the double whammy of student loan payments resumption and tightening monetary conditions.

Inflation

Another concern is that of inflation, the boogeyman from 2021/2022 that may be making a comeback. In 2021, inflation was an issue, but it didn’t really kick into high gear until late 2021 into early 2022, especially after the Russian invasion of Ukraine.

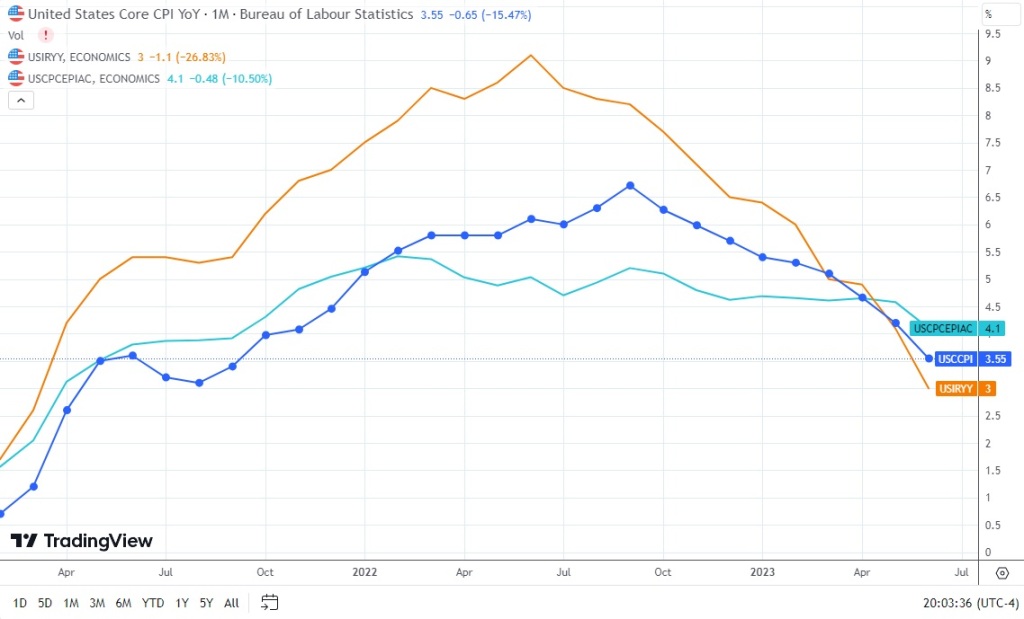

A large part of this was due to the huge spike in crude oil prices after the invasion, but which also started coming down around mid June 2022. As you can see from the graph below, inflation (orange line) looks almost like a slightly lagged, and very exaggerated version of crude oil price (candle bars):

Right now, it appears that crude oil prices is moving up again, but unlikely early 2023 when crude was around the same levels now, crude oil prices in July 2022 was much lower than crude oil prices in January to June 2022:

As a result, the drag of crude oil prices on year over year CPI is likely to be much less muted in July than for the first half of the year.

One way of visualizing crude oil prices’ impact on CPI inflation is by comparing CPI inflation (orange line) to core PCE inflation (teal line) and core CPI inflation (blue line) — core PCE inflation and core CPI inflation exclude the effects of food and energy prices:

As can be seen, the core inflation measures are much less affected by the spike in energy prices from February 2022 to June 2022. This in turn suggests that while the core measures may continue their down trends, headline CPI inflation may see moderate its decline, and may even inflect slightly higher for July. CPI inflation measures are due this Thursday, August 10th.

Weakening earnings

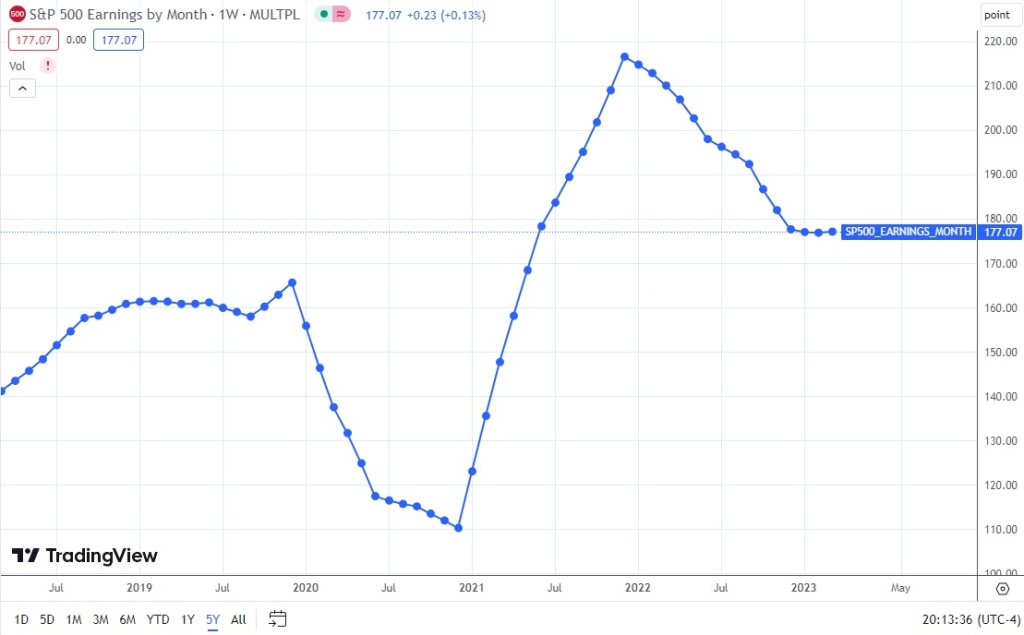

Earnings for the S&P500 has been weakening steadily since early 2022:

While the weakening seemed to have plateaued in early 2023, recent earnings report (especially from Apple, the largest company by market cap in the USA) seems to suggest that the weakening may be reaccelerating. To be clear, earnings season for 2023Q2 isn’t over, and the weakening may just my overthinking it.

Technicals

Unless you’ve been living under a rock, you’d know that the markets have done pretty well so far this year. Some may say too well — on a short term basis, it seems like the markets may be taking a breather, with a small plateau forming. A plateau that I’m betting (hoping!) will turn into a small correction in the near term.

Final words

As always, I want to be very clear that I cannot predict the future, and that this bet that the markets will go down is a very small part of my portfolio. This is, for now, a short term trade, which I may close out or reverse at any time. Follow at your own risk.

Footnotes

- Disclaimer: I’m only listing 1 (out of 10+) of my brokerage accounts on StockClubs. While it is one of the largest brokerage account in terms of asset value, it is still less than 10% of my portfolio.

- Yes, nobody can see the future. Sadly.

In the time from Aug to Sep, has your thesis changed? S&P500 has been flat, but QQQ & big tech have been green from the time of this post.

LikeLike

Nope. 🙂

LikeLiked by 1 person