Foreword

The world is in a bad place today — war rages on continental Europe, a phenomenon that hasn’t occurred for almost 80 years. The middle east is bathed in conflict, with Israel locked in fierce combat with its neighbors and Iran, while multiple less publicized conflicts wage across many parts of Africa. In total there are well over 100 armed conflicts currently in the world.

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Distasteful

Before we begin, I must admit that I find war distasteful. It is a depressing state of affairs, when one group of human beings thinks that the best, or only, way to resolve their grievances, is by the wanton destruction of properties, and the violent taking of lives of other human beings. It should not have to be this way!

But it is. Unfortunately, I do not have the power to unilaterally fix things and avoid war, so there is only the next best thing to do — plan and prepare for how it may affect me.

This is, primarily, a finance blog, and so we will focus on the finance and economics of war. Parts of this post may be distressing to some, and distasteful to many, but this post is only about the finance and economics of the situation. My apologies in advance.

USA

I also want to note that I am American, and so this piece is USA-centric. The USA enjoys many advantages that other countries simply do not — having control of the global reserve currency, having a large land mass relative to population, having a relatively large population, a vibrant economy, (relatively) stable politics, abundant natural resources, etc.

Some of the arguments below may not apply to other countries which do not enjoy these same benefits.

Recession

There has been a steady drumbeat of people calling for recession, and some of them point out to the various large scale conflicts in the world today, and how some of them are likely to drag (or have already dragged) the USA into them, and how these conflicts will drain the resources of the USA and lead to a recession.

The situation, I think, is far more complicated than that. (Un)fortunately, war is not always bad for the economy.

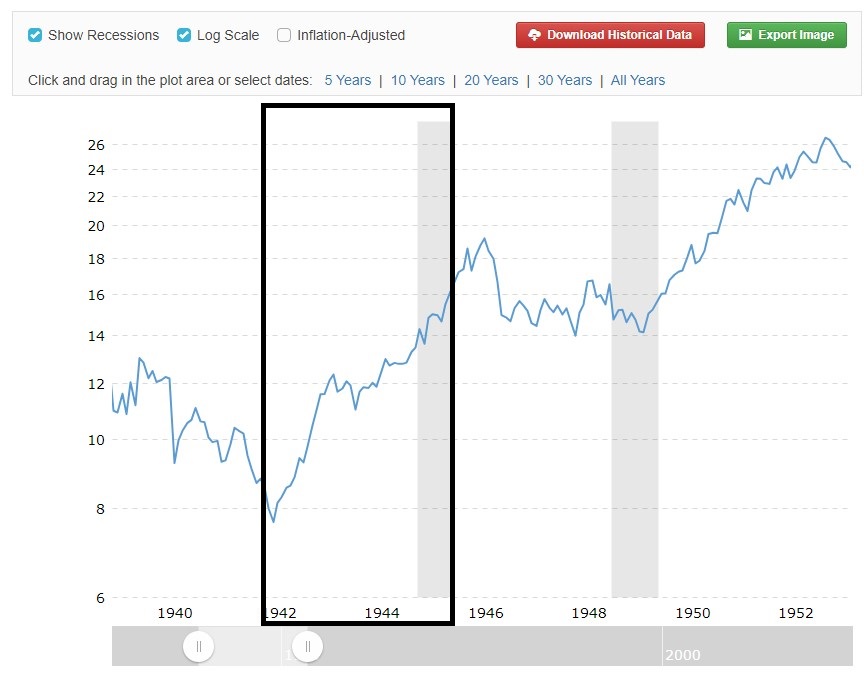

Take for instance War World 2. The USA officially entered the war in December 1941, and the war ended officially in September 1945. These are the graphs of the S&P500 and DJIA, with that time period highlighted (not exact, eyeball estimate), courtesy of Macrotrends:

As you can see, despite the rhetoric, the stock markets actually went up, and significantly during the period of time.

What gives?

As we’ve discussed early, war is terrible. It leads to the wasteful and mindless destruction of properties and lives. However, things need to be put in perspective.

During World War 2, the battles were almost entirely fought outside of American soil. As a result, other than Pearl Harbor and various military installations/equipment around the world, the USA actually did not suffer much property losses. Those countries that did suffer such losses, such as much of continental Europe, many parts of Asia, and parts of Northern Africa, did indeed see dramatic economic and financial suffering — their means of productions (power plants, factories, industrial vehicles, offices, etc.) were damaged or destroyed, and that naturally has a huge and negative impact on productivity. But the USA mostly escaped that fate.

Separately, the war effort needs to be financed. Soldiers need to be trained, equipped and paid, military hardware needs to be procured. All of these result in a transfer of wealth from the government to the private sector, in the form of payments for services or products, salaries to the soldiers, etc.

The fact of the matter is, a recession is, first and foremost, an unwillingness of participants in the economy to spend, leading to a dramatic drop in the velocity of money (i.e. how fast money gets spent, earned and then re-spent). If there is a large entity with effectively unlimited wealth, such as the US government, willing to spend huge sums of money, then how can a recession happen?

Another important thing to note is that after the war, the USA was the largest unscathed country. It thus naturally enjoyed the benefits of, almost literally, being the only country still able to produce in bulk many of the products needed to rebuild the rest of the world. Many academics have argued that in addition to the new factories largely financed by the US government during the war, this resulted in the beginning of the USA’s global financial and economic dominance.

To put it crudely, World War 2, despite its many human tragedies, was an economic and financial boon to the USA, pretty much from 1941 till today.

National debt

To be clear, the US government took on a lot of debt to finance its war efforts, and after the war, there was a period of adjustment during the late 1940’s to pay down that debt. Eventually, pain needs to be suffered if one incurs debt — either the debt is paid down slowly via small deductions over time, or all at once via severe austerity, or via default (which wipes the debt, but imposes many other penalties). Though as we have seen in more recent times, “eventually” can be very, very far off in the future.

While much of that money is wasted on destructive efforts, a lot of it was also spent on productive efforts, like the aforementioned new factories subsidized by government spending.

Germany and Japan

There are some who claim that war is profitable for the winners, and detrimental for the losers. That is also not something I agree with.

Two of the largest losers of World War 2 were Germany and Japan — Both were part of the Axis powers which lost the war. However, Germany is, and has been, the strongest economy in the European Union for many years now, and Japan was, briefly, a contender for the largest and strongest economy in the world in the late 80s, a mere 40 odd years after the war.

The key, I think, is again due to the destruction, or lack thereof — while the Axis powers inflicted much damage to the countries they invaded, they themselves suffered relatively mild property (and more importantly, productive assets) damages, as the end of the war was relatively swift compared to the length of it.

Not all fun and games

To be clear — I am definitely NOT advocating for war. It is, again, a senseless and horrific waste of resources, lives and treasures. However, I do not agree with many of the sentiments flying around that war is strictly bad economically or financially for the USA. As we can see from the largest war mankind has known to date, whether war is good or bad financially and economically, depends a lot on the circumstances.