Foreword

This is a quick note, which tends to be just off the cuff thoughts/ideas that look at current market situations, and to try to encourage some discussions.

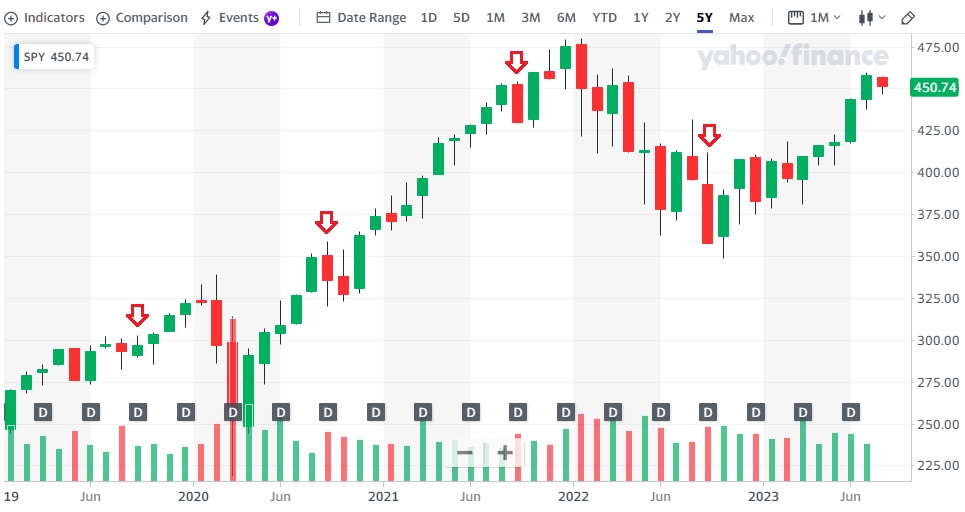

It’s earnings season again, and if you’ve read Making moves, you should know that I’m short the market since around early August. What’s next?

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Update

First off, a bit of an update on the August short:

I shorted the market with a small portion of my portfolio using highly levered puts. Because much of my portfolio is flat, and because the puts were quite a bit out of the money, I ended up being net short the market slightly, with a positive gamma (i.e. the more the market falls, the more short the market I become).

If you follow me on StockClubs (1), you’ll notice that the put spread I bought expires in mid November. I have similar trades (shorting SPY, VOO, or long VIX) in other accounts, some of which have different expiry dates.

The market has since fallen quite a bit, and so far, I am up on this position — roughly 50% across all accounts.

Earnings

As earnings season rolled around, some folks on StockClubs noticed that I have opened shorts on various names (so far TSLA, NFLX, GOOG, MSFT, SNAP), and asked about those positions.

In each of these cases, the position is a short bet using put spreads that expire soon (the very next expiry in all cases), targeting a max gain of 2-3x when the stock drops around 3-5% post earnings.

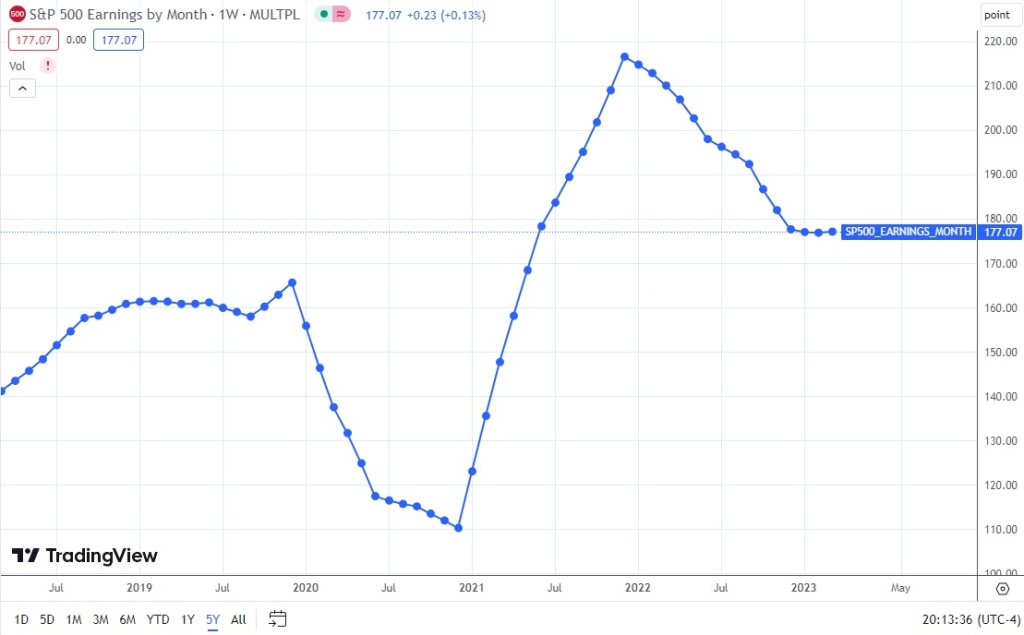

The rationale for these bets is simple — if you’ve been following the earnings season so far, companies that report poor results, and even some companies that have reported decent results, have been punished severely, while companies that reported good results have generally been muted.

For example, yesterday GOOG reported overall decent results, though one segment (cloud) did poorly, and their stock was punished by a 9% drop today. MSFT, on the other hand, reported pretty good results, and their stock is only up around 4%.

I am trying to play this apparent downward bias after earnings report.

So far, I’ve been correct on TSLA and GOOG, and wrong on the rest (NFLX, MSFT, SNAP). But because the gains are so biased towards the downside (2-3x gains for a relatively small drop), I’m actually ahead quite a bit after tallying up all wins and losses.

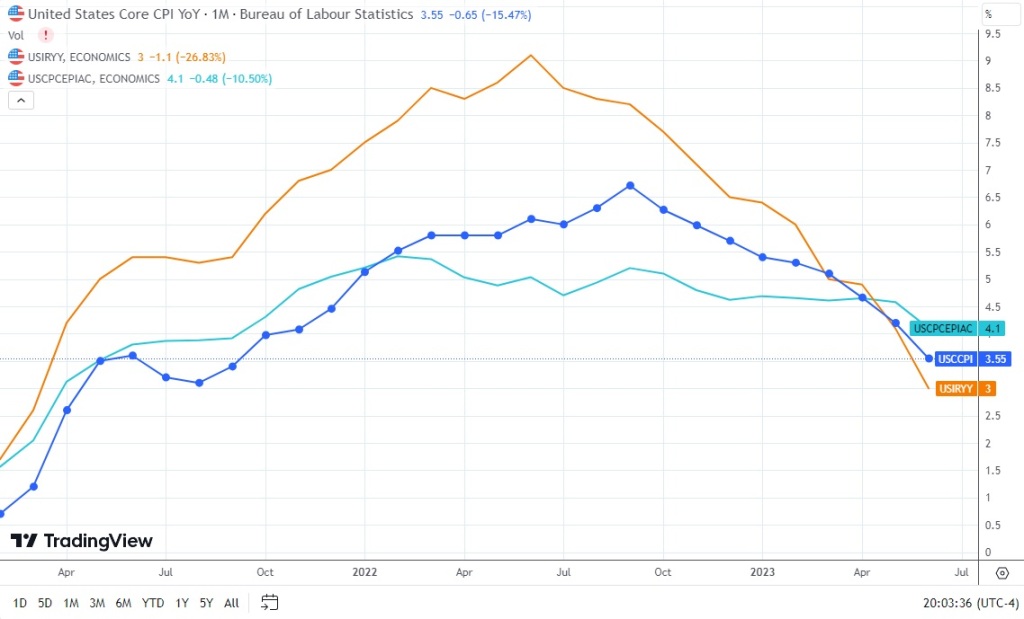

On top of this bias towards the downside, most of the factors mentioned in Making moves still apply, which further helps with the probability of downside profits.

Discussion

For those who aren’t aware, StockClubs now feature comments on trades and discussion posts to encourage more community engagement. If you have questions about my trades, feel free to ask in the app. See you there!

Footnotes

- Disclaimer: I am an investor in StockClubs, and only one (out of 10+) of my brokerage accounts are shown there.