Foreword

SPY is the first S&P500 ETF ever listed, and because of that first mover advantage, it has amassed a large number of shareholders. However, VOO, a competitor from Vanguard now beats SPY by net asset value, even though it launched much later. Should you switch?

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Background

SPY is an ETF that tracks the S&P500 index, and so is VOO. In practice, the ETF providers have some leeway on how they actually implement the fund, but for the most part, they have a very high correlation and most people can treat them as effectively the same thing.

However, SPY has a 9bps (0.09%) expense ratio, while VOO has a 3bps (0.03%) expense ratio, making VOO slightly cheaper in terms of fees that users pay to own the shares 1.

Because VOO has a lower expense ratio, and I believe it is one of the cheapest, if not the cheapest, S&P500 funds, it has drawn significant interest from many investors.

Expense ratio

You can think of the expense ratio as roughly “how much I pay per year to own this fund”. So for SPY, if you’ve bought $10,000 worth of SPY shares, then every year you will pay about $9 — this is done by the fund provider selling $9 worth of assets in the fund to cover your share of the fees. One way to think about it is, absent all other factors, the value of your holdings in the fund goes down by $9 per year.

Similarly, for VOO, you will pay about $3 per year if you had bought $10,000 worth of VOO shares.

So, if you bought VOO instead of SPY, you would save about $6 a year.

$6 isn’t a whole lot, but it’s not nothing. And given that there’s nothing you need to do, it seems like a no-brainer, right?

Liquidity

If it is a no-brainer, then why does SPY even have shareholders? Why don’t all investors just sell out of SPY and buy VOO instead? And why hasn’t the provider of SPY just lowered their fees to compete?

Well, the answer is that it is not that simple. It never is.

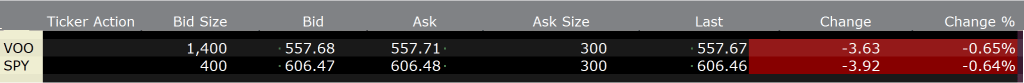

This is a screenshot from Interactive Brokers sometime this afternoon (Feb 21st, 2025) showing the prices of SPY vs VOO (edited to show the relevant bits):

As you can see, VOO has bid/ask prices of 557.68 vs 557.71, while SPY has bid/ask prices of 606.47 vs 606.48. As a simple model, let’s say the “correct” prices of a security is the midpoint price, i.e. the average of the bid and ask price. So for VOO, the “correct” price is 557.695, while for SPY it would be 606.475.

From the quotes, VOO trades with a spread (ask price – bid price) of 3 cents, while SPY trades with a spread of 1 cent. As a rough approximation, you can think of the spread as how much you pay (excluding broker and exchange fees) every time you buy and sell (i.e. one roundtrip) a share. So if you buy and immediately sold VOO, you’d pay 557.71 to buy, but only get back 557.68 when you sold, giving you a loss of 3 cents.

So, as a percentage of the “correct” price, the spread for VOO is about 0.5bps (0.00005%), while the spread for SPY is about 0.2bps. In other words, if you trade in and out of both SPY and VOO, you’d pay about 3x more for the trades due to the spread for VOO, than for SPY.

In concrete terms, if you buy $10,000 of SPY, you’ll pay in spread about 8 cents (0.01 * (10000 / 606.475) / 2), while for VOO, you’ll pay about 27 cents (0.03 * (10000 / 557.695) / 2). Note that divide by 2, because we are only buying and not selling, so we “pay” half the spread2. Or, if you trade in and out of either position, you’ll pay 16 cents for SPY and 54 cents for VOO.

Given these numbers, if you trade in and out of your position 16 or more times a year, then it would make more sense to trade SPY than VOO — even if you hold the position everyday at the end of day, and thus pay the full $6 additional fee for holding SPY, you’ll more than make up for that by paying less in spreads when you trade — (54c – 16c) * 16 = $6.08.

If you don’t even hold the position at the end of every day, then trading SPY will come out further ahead, since you will pay a smaller fee to the provider (as a ratio of how many days you actually own the position out of the year).

16!

“But I’m a buy and hold investor”, you say, “I’m not going to trade in and out 16 times a year!”

And that is very true. Most people do not turn over their entire portfolio 16 times a year.

But that’s just one part of the liquidity story.

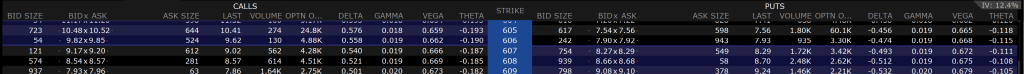

Here are some screenshots (again, edited for focus) of options expiring on March 21st, 2025 for SPY:

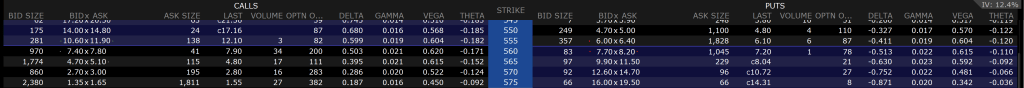

and VOO:

As you can see, an at the money call option for SPY trades at 9.17/9.20 bid/ask, while a similar at the money call option for VOO trades at 7.40/7.80 bid/ask.

As a percentage of the “correct” price per share, the SPY option has a spread cost of about 0.5bps, while the VOO option has a spread cost of about 7bps, an order of magnitude higher.

Which is to say, if you, like me, like to occasionally sell calls against, or buy puts to protect your S&P500 position, just buying 2 rounds of puts (or selling 2 rounds of calls) per year will result in SPY being a better vehicle for your portfolio — You’d pay roughly 6.5bps higher in spread costs to buy 2 rounds of puts (or sell 2 rounds of calls), if you let the options expire (i.e. you only pay the half the spread cost per trade), if you had used VOO instead of SPY (edit: for clarity).

While I don’t really trade that much, I almost definitely sell more than 2 rounds of calls per year on my holdings to juice my returns when I feel that the markets are especially richly valued, so for me, personally, trading SPY is usually a better idea.

Summary

While it is true that holding VOO is cheaper in terms of fees paid to the fund provider, be careful of all the other costs of investing. The 6bps you save per year by holding VOO instead of SPY is easily eroded if you trade options or the underlying even semi-frequently.

Of course, if you are a pure buy and hold investor who holds for the long term, then as of right now, VOO does indeed seem to be a no-brainer.

Great breakdown as usual. Why does SPY have a consistently smaller spread than VOO? Some searching has led me to find that trading spreads are smaller when a fund has more AUM (assets under management).

This seems like something Vanguard could remedy since at a big picture, they have more AUM as a firm than State Street Global Advisors which manages SPY. So I’m guessing there’s some characteristic to VOO (maybe expense ratio) that would be altered by increasing VOO’s AUM?

Source for VOO AUM

Source for SPY AUM

LikeLike

AUM is not really a factor. It is trading activity that results in smaller spread.

Having a large AUM is generally correlated with higher trading activity, but not necessarily so.

As far as I can tell, SPY has more trading activity simply because by some random stroke of luck, that’s the one that most traders flocked to early on, and it just kinda stuck.

LikeLike