Foreword

This is a quick note, which tends to be just off the cuff thoughts/ideas that look at current market situations, and to try to encourage some discussions.

Markets took another drubbing today, and is now less than 20 SPX points away from year to date lows, almost 25% below the highs just a few months ago.

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Ouch

If you follow my blog posts, and/or if you follow me on StockClubs (1), you will know that while I’ve flattened my portfolio (i.e. reduced exposure to equities/bonds), my portfolio is not flat. As a result, the absolute drubbing in the markets, for both stocks and bonds, in the past month or so has not been fun.

As it stands, we are now less than 20 SPX points away from the lows set in June, and given the relentless selling of the past few trading days, there is a good chance that we’ll visit and maybe go below that in the coming days.

Bear market

Talking to a few friends, it seems like some are still heavily invested in stocks and bonds, and I can only imagine the pain they must be experiencing. At the same time, I get the feeling that quite a few people are essentially paralyzed with shock at the speed and magnitude of the moves so far this year — if you started investing after 2009, then you most likely have only experienced “happy times” in the markets. This year would (other than the rather brief March 2020 downturn) be the first major bear market you’ve experienced.

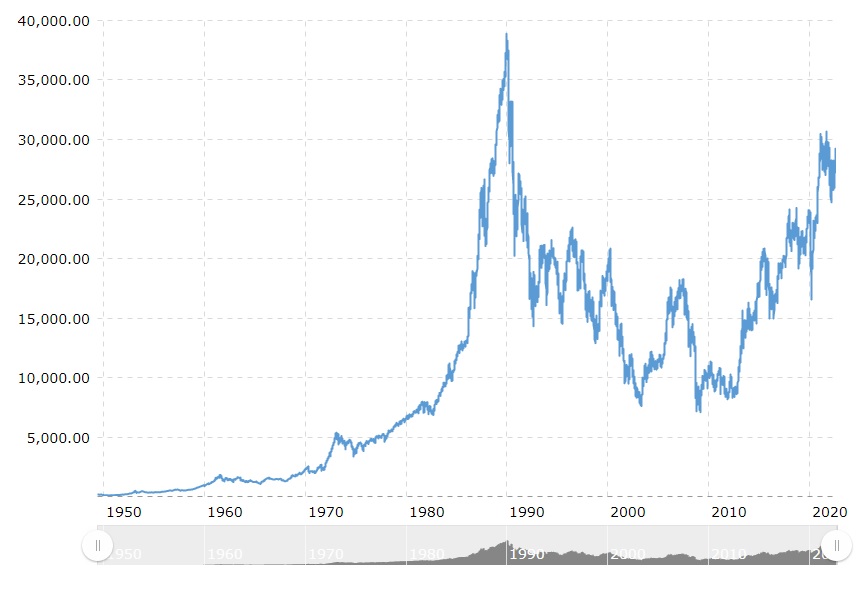

Bear markets happen, and they can last for a long time, with many, many dead cat recoveries that morph into new lows — the Nikkei 225 still has not recaptured its peak set in the late 80’s/early 90’s, about 30 years ago:

Will the SPX also take 30 odd years to not recover? I don’t know, and frankly, nobody does. It is certainly possible, though history across all the major developed markets suggests that this is unlikely — recovery to prior peaks for even fairly severe drawdowns (like the 2008 Great Financial Crisis) rarely take more than 5-10years.

As investors, all we can do is make projections, and allocate our portfolio accordingly. But as noted in Marathon, we should also make preparations for the worse/worst case scenarios, for the unknown unknowns, for when the bear awakes and takes a swipe at our portfolios.

So, if you’ve been paralyzed with indecision thus far, you need to make a decision, even if the decision is to “do nothing”. It is certainly a hard decision to make, given that you are likely sitting on a bunch of losses and realizing the losses (by selling) will make it that much more real. Sitting tight could very well see you made whole or more…, or we may drop another 25% or more.

An easier decision to make, however, is if you have immediate needs for money that cannot be deferred. If so, you should seriously consider keeping enough liquidity (i.e. cash or cash equivalents) on hand, so that your near term money needs can be met. If the market recovers, treat it as premiums for insurance against failing to meet your obligations. If the market drops more, you’ll certainly be relieved you cashed out and won’t have to worry about near term needs.

Footnotes