Foreword

This is a quick note, which tends to be just off the cuff thoughts/ideas that look at current market situations, and to try to encourage some discussions.

As usual, a reminder that I am not a financial professional by training — I am a software engineer by training, and by trade. The following is based on my personal understanding, which is gained through self-study and working in finance for a few years.

If you find anything that you feel is incorrect, please feel free to leave a comment, and discuss your thoughts.

Disclaimer

My usual stance is to not write about anything that can be construed as “investment advice”, because I’m simply not qualified to provide that to anyone. This post diverges slightly from that.

In this post, I talk a little bit about my thoughts on inflation, and how I would (and currently am) hedge for inflation. This is entirely my personal belief, and what I’m doing for my own portfolio. More importantly, I may change my mind at anytime, and I may or may not write about it, and may or may not otherwise notify you when I change my mind.

Please do your own research, and consider carefully what is right for your own personal situation. What is right for me, may not be right for you.

Janet Yellin’

Janet Yellen, the previous Federal Reserve Chair and current Treasury Secretary, just had a very interesting press conference. As opposed to the Federal Reserve, which has been steadfastly saying “inflation is transitory”, Yellen gave a much more nuanced take, and suggests that higher inflation, as high as 3%, may be acceptable to the government. Given that officially reported inflation in the US is somewhere between 0 and 2% for the past decade or so, that’s pretty big news — even a 1% increase in inflation can result in significantly higher prices over long periods of time — 0% compounded for 10 years results in prices that are exactly the same, 1% compounded for 10 years leads to a ~10% increase, 2% leads to ~22% increase, and 3% leads to ~34%.

There has already been considerable consternation in the markets about higher inflation, with a scare earlier this year leading to a ~12% sell off in QQQ, and some more risky stocks dropping as much as 50-60%. So yeah, everyone’s talking about inflation. Yellen making it official, doesn’t seem like it’s going to help sentiments.

How high is high

Generally speaking, I think of inflation as several buckets (all numbers per annum) (1):

- 0 – 1.5% – Low inflation

- 1.5 – 2.5% – Normal inflation

- 2.5 – 5% – Medium inflation

- 5% – 10% – High inflation

- 10% – 12,900% – Very high inflation

- 12,900+% – Hyperinflation (2)

Note that the range for each bucket generally increases as you go down the list. This is by design — historically, inflation tends to grow exponentially (or at least, at a polynomial rate), which with some hand-waving, sort of means it’s easier to get from 6% inflation to 8% inflation (a jump of 2%) than it is to get from 1.5% to 2% inflation (a jump of 0.5%). This is also why central banks tend to, or at least, used to, be very wary of inflation — beyond medium inflation, it becomes very easy for inflation to get out of hand very quickly. When that happens it becomes really, really hard to get inflation under control.

Transitory?

The next question is, is inflation transitory? And the answer is… yes. No. Maybe?

It depends on what you mean by “inflation”. Inflation just describes a phenomenon, and therefore, technically, is always with us — even deflation is basically just negative inflation. More accurately, I think the question is, “is higher than normal inflation transitory?” And the short answer is — I don’t know.

But if I were to guess, then I think that it is unlikely that the US gets to high inflation in the near term (say, next 1-3 years). And even if it did get to high inflation, it’ll probably be transitory (say, less than 1-2 quarters).

As for medium inflation (which is still higher than the normal 1-2% we’ve been seeing), I used to think that it’ll be transitory and maybe last at most 1-2 quarters. But recent events, and Yellen’s speech, changed my mind, and I think we may see it for maybe 4-5 quarters, possibly even up to 2 years. Most of this has to do with how the economy is not really returning to normal evenly, and certain sectors are facing severe supply issues.

What I am doing

Given that I don’t think high (much less very high/hyper inflation) are in the cards, then it seems unlikely that inflation will be so high that it causes severe distress to many businesses (Some yes; Many, probably [hopefully] not).

So the core thrust of my thinking is that selective investments in productive assets (i.e.: businesses) should work. The key question is, which sectors/industries?

Bare necessities

My thinking, again, personal opinion, may be wrong, is that basic goods and services will still be in demand. So things like

- Housing

- Consumer staples

- Healthcare

- Utilities(-like)

will be in demand. And to the extent that the businesses in these industries/sectors can keep their costs under control and adjust their prices to account for inflated input costs, they should do well (3). Maybe even better than other sectors/industries. In my mind, non-“bare necessities” like consumer discretionary may suffer for 2 reasons:

- Higher inflation tends to sap savings and reduce disposal income, leading to cutbacks on non-essentials.

- In the past ~12 months, we’ve already seen an explosion in discretionary spending, which is likely to end once the stimulus and its effects die down; Usually, these types of pent-up spending tends to just pull forward demand, which means forward demand should be reduced — you only need so many Peloton bikes.

So, for the near term, say 1-3 years, I’m guessing the above sectors/industries will do slightly better than the others (4).

Note that for housing, I’m particularly in favor of multi-family housing, since that’s generally the most cost-effective option for the budget conscious, and for utilities(-like), I’m favoring those that are not deemed “natural monopolies” and thus heavily regulated (to the point where they cannot easily raise prices to offset increasing costs).

Can I be wrong?

You should always, always, always assume that whatever financial analysis you read has a high chance to be wrong, either intentionally (the author is malicious) or unwittingly (the author is just wrong) — nobody can see the future.

That said, here are some risks, that I can think of, to my guesses above:

- Currently, various forms of fiscal stimulus are ending. If the government extends or comes up with new stimulus, then the above will likely be horribly wrong.

- Currently, the Federal Reserve’s official stance is no interest rate hikes, though they are going to start talking about it. If they dramatically pull forward the timeline of hikes, or dramatically push back the timeline of hikes (I’m guessing first hike to be around 2022 – 2023), then the above may be horribly wrong.

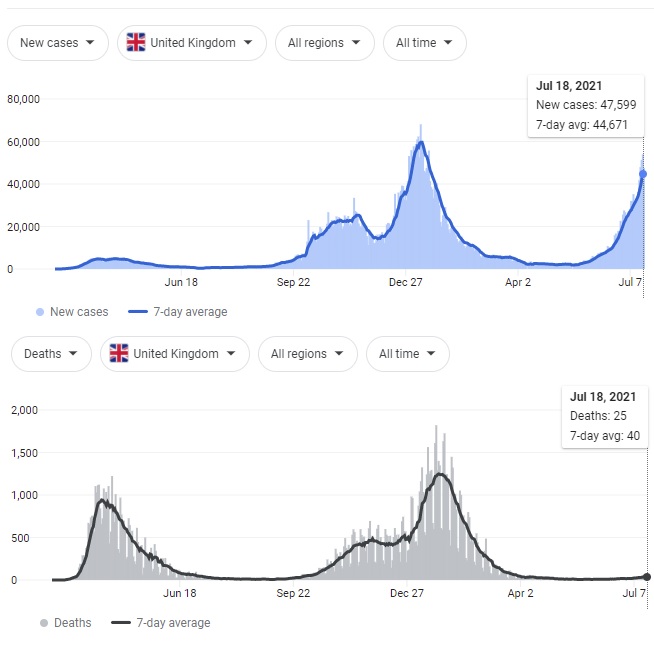

- Currently, the pandemic is ending in most developed countries, and peaking in most developing countries. To the extent that reopening proceeds at a reasonable pace (say, full reopening by end 2022 in most/all developed countries), the above is probably fine. But if not, then the above may be very wrong.

- Currently, I’m not yet a complete idiot. But if I were…